AN OVERVIEW

What is Natural Gas?

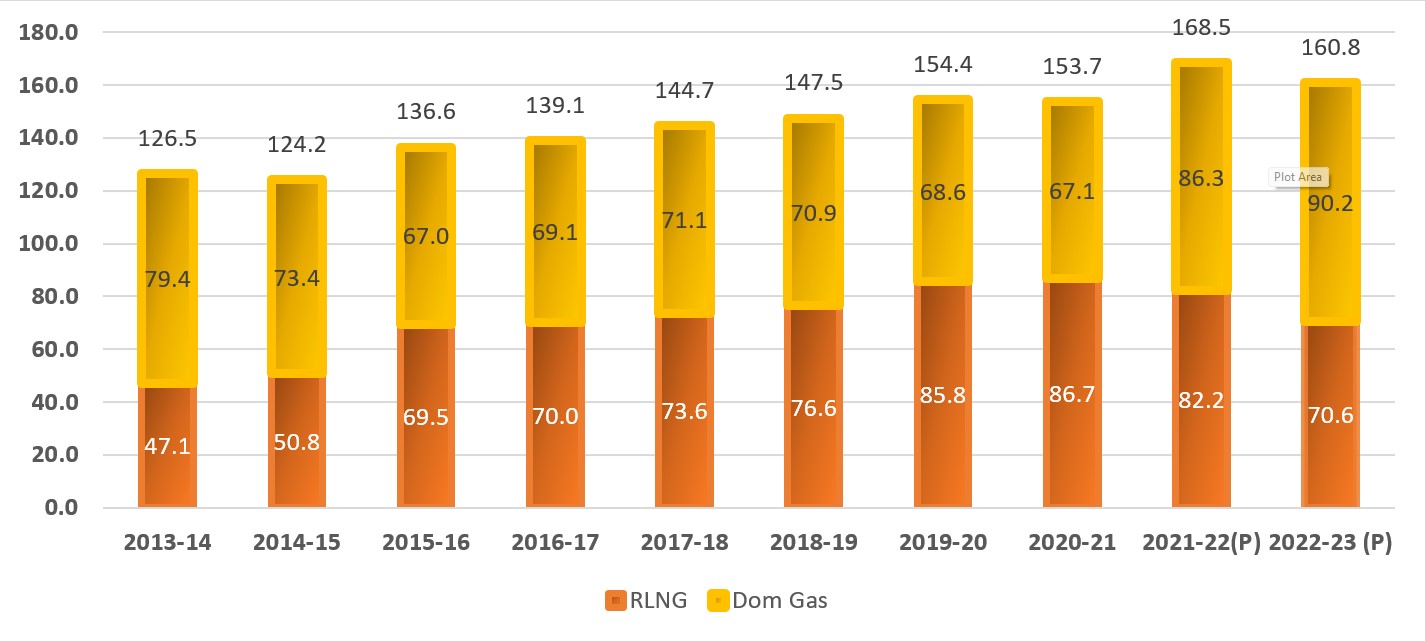

Natural Gas consists mainly of Methane and small amounts of ethane, propane and butane. It is transported through pipelines but is extremely bulky. A high-pressure gas pipeline can transport in a day only about one-fifth of the energy that can be transported through an oil pipeline.Annual Trends in India’s Natural Gas Consumption

Source: PPAC, (P) is provisional

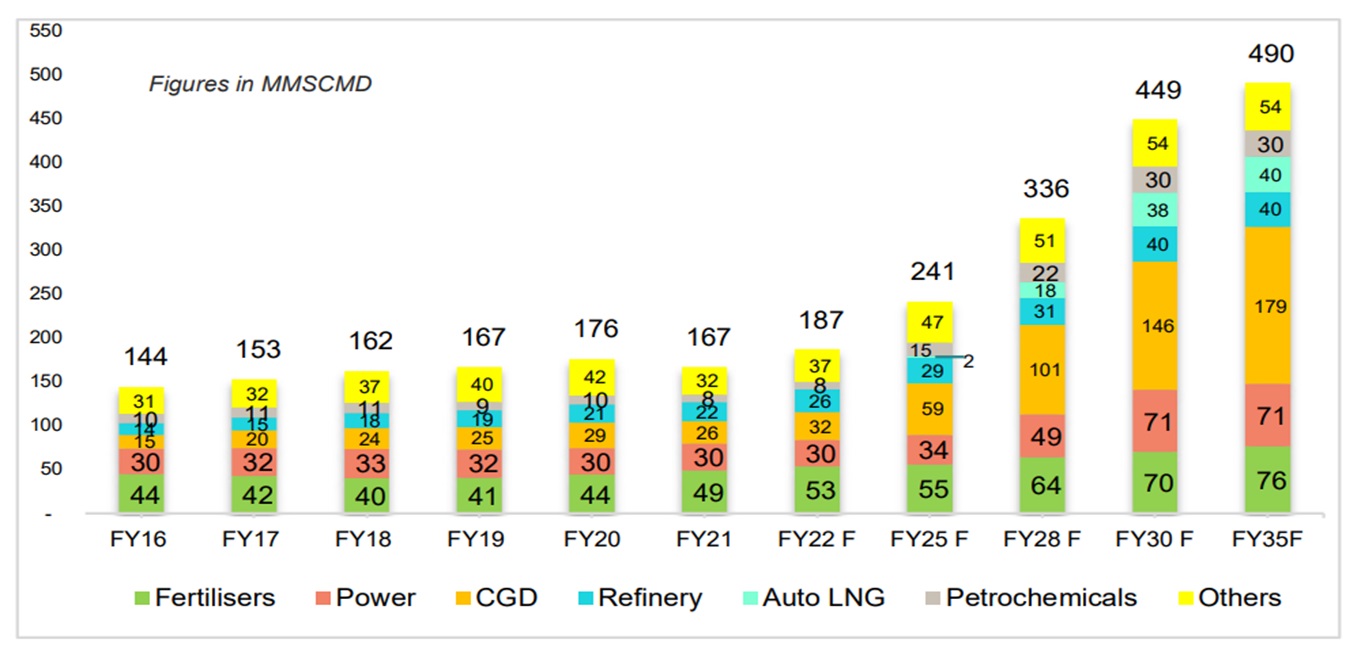

Expected growth in natural gas demand by segment

(*Forecast by Crisil) –

The most important consumers in the downstream value chain include Fertilizer, City Gas Distribution (CGD) and refinery and petrochemicals.

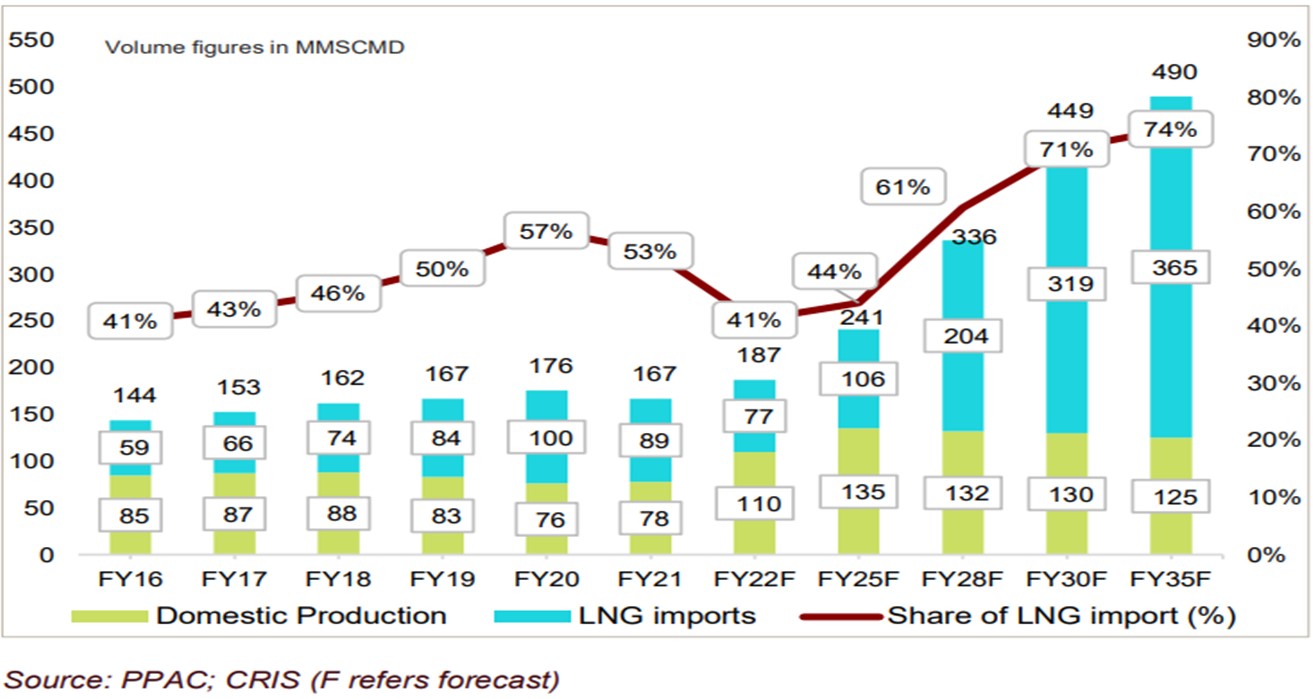

Benefitting the GoI commitment and strong consumption profile, the demand of natural gas is expected to grow to 490 MMSCMD by FY2035, exhibiting 8% CAGR during FY21-35.

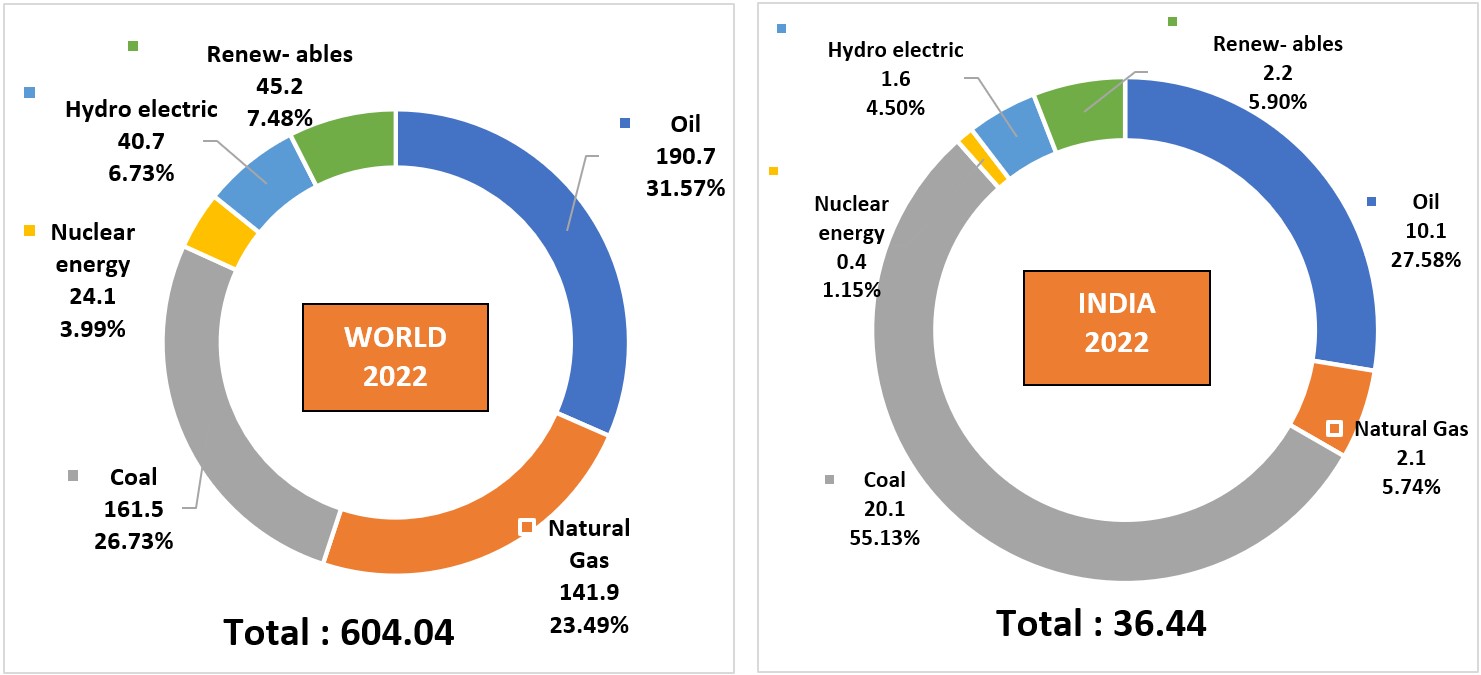

Primary Energy: Consumption by fuel, India Vs World (Exajoules and Percentage)

Source: Energy Institute Statistical Review of World Energy 2022 data, June 2023, Data in EJ – Exajoules

| Year 2022 | World | India | ||

|---|---|---|---|---|

| Sector | WORLD 2022 (Exajoules) | Percentage | INDIA 2022 (Exajoules) | Percentage |

| Oil | 190.7 | 31.57% | 10.1 | 27.58% |

| Natural Gas | 141.9 | 23.49% | 2.1 | 5.74% |

| Coal | 161.5 | 26.73% | 20.1 | 55.13% |

| Nuclear energy | 24.1 | 3.99% | 0.4 | 1.15% |

| Hydro electric | 40.7 | 6.73% | 1.6 | 4.50% |

| Renewables | 45.2 | 7.48% | 2.2 | 5.90% |

| Total | 604.0 | 100.00% | 36.4 | 100.00% |

India’s share in global energy consumption is expected to rise from around 6 % to 13% by 2050; Natural gas to play a pivot role in energy transition.

Strong energy consumption profile is supported by lower yet growing per capita energy consumption and growing population

- Per Capita energy consumption is expected to increase from current 1/3rd of global average.

- Favourable working age population, Increasing economic activities, rising incomes and living standard presents a huge scope of growth in energy consumption.

With sustainable development at core of India’s advocacy, pressing need of cleaner fuels

- GoI targets to install 500GW (300% growth) of renewable capacity by 2030.

- Paris agreement – India pledged to reduce GHG emissions intensity by 33-35% by 2030 below 2005 levels

- The nation targets 40% share of non-fossil fuel in power capacity by 2030

- At COP-26, India announced its ambition to achieve net zero emission by 2070

Natural gas to play crucial role in energy transition, fulfilling the nation’s growing energy demand

- Due to cyclical nature of renewable, reliable energy storage system or back-up fuel is required to ensure intermittent power supply.

- Natural gas is the cleanest burning fossil fuel to fill the desired supply gap and hence serve as “LONG BRIDGE” in the desired transition towards the cleaner fuel over the next 3-4 decades.

Key drivers for gas demand in sectors

- City-Gas Distribution (CGD)

Conversion of petrol/diesel vehicles to CNG

- Low cost and emissions of CNG over petrol/diesel Low cost and emissions of CNG over petrol/diesel

- Vehicle scrappage policy by India to further push the conversion.

New GAs to add more demand

- Development of new GAs allotted in CGD rounds 9,10,11,11A will boost gas demand.

- Round 11 included 65GAs (61GAs awarded)

- Round 11A included 6GAs

Regulatory ban on polluting fuel

- Ban by The National Green Tribunal on usage of liquid fuel such as fuel oil (FO)/ pet coke

Rising number of CNG retail outlets

- CNG retail outlets is expected to grow to ~ 10,000 by FY27 from current 4000 stations across India

Increase in number of domestic PNG connection

- Expected Increase in domestic PNG connections to ~ 200 lakh by FY26 vs ~91 Lakh in Feb-2022.

- Fertilizers

- GoI mandated plants to shift from liquid fuel to natural gas

- Increase in domestic urea manufacturing capacity will support high gas demand

- Urea demand will also be driven by increased agricultural activity.

- Subsidy on production cost enables the producers to absorb high gas price

- Difference between selling and cost price will be reimbursed by government, enabling manufacturers to continue rely on gas

- Refining & Petrochemicals

- Make in India Campaign to boost gas demand, the campaign will benefit the manufacturing industry such as automotive requiring more plastics.

- Increased focus on agriculture and irrigation will influence demand for petrochemical fertilizers.

- Planned Capex for additional development and capacity expansion

- By FY25, 25-30 MT of refining capacity is expected to be commissioned. GoI thrust to improve national infrastructure

- Increase in demand for synthetic material for construction will boost gas demand.

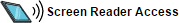

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country