While majority of global economies faced slowing growth with high inflation, on account of an unprecedented volatility in the global energy and commodities markets, however, India remained a bright spot, mainly driven by expansion in infrastructure, private consumption, expansion in rural demand, and its focus on manufacturing. Also, India’s large and demographically young population is now regarded as an asset and an opportunity. In a world in which many countries are meeting requirement of aging population and even population decline, by contrast, India’s population is young – the median age is 28 years. Every sixth working age (15-64 years) person in the world is an Indian. This presents a huge potential for expanding investments that will considerably enhance India’s emergence as the world’s economic powerhouse of the future, followed by the exponential growth in the energy and gas consumption. With the move towards clean energy, high polluting energy consuming sectors are likely to see more shift towards natural gas.

The Government of India has implemented several major policies aimed at developing and improving the Country’s infrastructure across various sectors, which will directly enhance energy requirement and thus natural gas consumption in the country.

Further, LNG being a Fuel which has virtually unending availability and is strongly vying for a position juxtaposed to renewables.

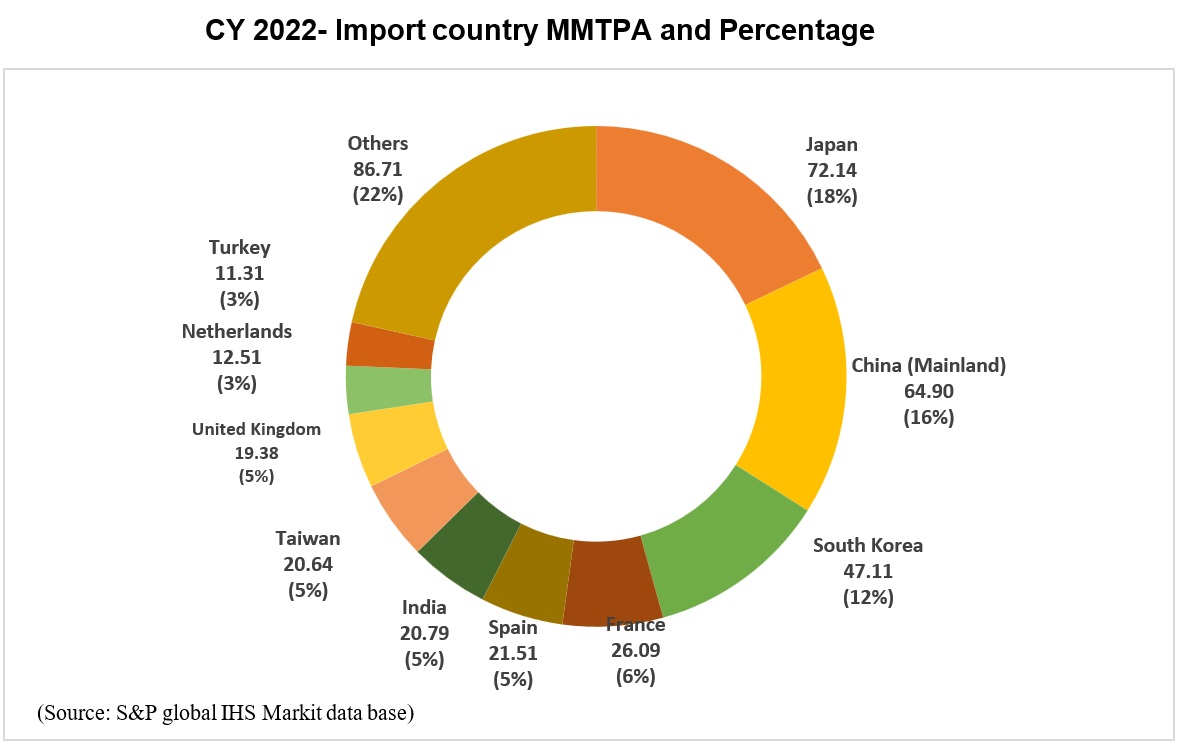

- Total LNG traded in World in year 2022 is 402.8 MMTPA.

- Import of LNG by India in year 2022 is 20.79 MMTPA which is 5% of total world LNG Trade.

- Highest being Japan (18%) followed by China (16%) and South Korea (12%)

India is dependent on imported LNG (45% of NG is imported) to meet its domestic demand. The LNG is imported either through long term (LT) contracts or through spot purchases (ST) from the international markets. Most of the long-term contracts are either Crude linked which are largely from Middle East or Gas linked which are from USA.

Indian Natural Gas and LNG: Need for long term contracts.

In India, Natural Gas is majorly consumed in Fertilizer, Refinery, Petro-chemicals, Industries and City gas. These sectors require reliability of supply and affordable price at predictable & competitive terms vis a vis alternative fuel.

India traditionally favoured the long-term gas sourcing. India has long term LNG contracts of around 20 MMTPA, which constitutes around 95% of around 21 MMTPA LNG consumption in the CY 2022.

Indian gas market, which is one of the few growing gas markets, can be developed in a better way on the basis of major percentage on Long Term Contracts rather than relying heavily on spot supplies, prices of which are highly volatile and do not provide energy security. Thus, long term contracts provide a solution for meeting demand of growing markets like India.

PETRONET LNG Sourcing & Capacity

- 7.5 MMTPA sourced through Long Term Contract with RasGas, Qatar with back-to-back sales arrangement with GAIL, IOCL & BPCL.

- 1.425 MMTPA LNG tied up from MARC – An Exxon Mobil's Venture in Australia with back-to-back sales arrangement with GAIL, IOCL & BPCL.

- Additional LNG being sourced through Spot /Short Term Contracts & sold to Offtakers/ Bulk Buyers from time to time.

- Company has executed long term firm capacity booking agreements totaling to 8.25 MTPA with major players like GAIL, IOCL, BPCL, GSPC and Torrent.

LNG Supply > Truck Loading

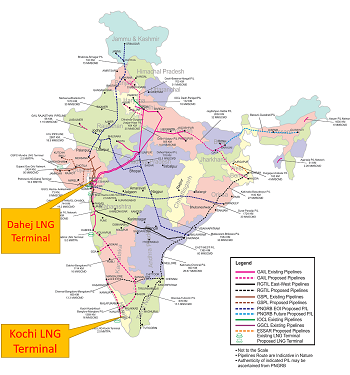

- Facilities to supply LNG through cryogenic tankers have been set up at Dahej and Kochi to meet the requirements of customers who do not have access to pipelines.

- Truck Loading facility at Dahej terminal was commissioned in August 09, 2007 and at Kochi terminal it was commissioned on July 25, 2014.

- More than 41,000 trucks at Dahej terminal and 4500 trucks at Kochi terminal have been loaded till July 2023.

- Facility can handle around 40 loadings/day at Dahej and 20 loadings/day ay Kochi terminal with further scope for expansion.

- Fast developing market with several new consumers (up to 1000 KMS) are being lined up for off-take of LNG for industrial and city gas use.

Direct Marketing

Direct Marketing Petronet plans to foray into Direct Marketing by focusing on the following areas:

- LNG/LCNG i.e., LNG through Trucks and supplies at LNG hubs, customer's premises in regions not serviced by pipelines.

- Executing MoUs/Agreements with CGD entities for development of LNG/LCNG/PNG infrastructure.

- LNG/RLNG trading on International and domestic platform.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country