Press Release

29th June, 2020

Petronet LNG Ltd

- Highest ever quantity of LNG in a financial year, processed at Dahej Terminal in FY 2019-20 at 885 TBTU

- Highest ever quantity of LNG in a financial year, processed by the Company in FY 2019-20 at 928 TBTU

- Highest ever PAT in a financial year, achieved by the Company in FY 2019-20 at INR 2,698 Cr

During the financial year ended 31st March, 2020 (current year), Dahej terminal operated at around 103% of its name plate capacity and processed 885 TBTU of LNG (highest ever in a year) as against 820 TBTU processed during the previous year. The overall LNG volume processed by the Company in the current year was 928 TBTU (highest ever in a year), as against the LNG volume processed in the previous year, which stood at 844 TBTU. The Kochi Terminal processed 43 TBTU in the current year as against 24 TBTU in the previous year.

During the quarter ended 31st March, 2020 (current quarter), Dahej terminal processed 206 TBTU of LNG as against 222 TBTU processed during the previous quarter and 199 TBTU processed during the corresponding quarter. The overall LNG volume processed by the Company in the current quarter was 219 TBTU, as against the LNG volume processed in the previous and corresponding quarter, which stood at 233 TBTU and 205 TBTU respectively.

The Company has reported PBT of Rs 3,111 Crore in the current year, as against Rs 3,234 Crore in the previous year. The PAT for the current year was reported at Rs 2,698 Cr (highest ever PAT in a year) as against the PAT of the previous year i.e. Rs 2,155 Crore.

The Company has reported PBT of Rs 486 Crore in the current quarter, as against Rs 902 Crore in the previous quarter and Rs 655 Crore in the corresponding quarter. The PAT for the current quarter was reported at Rs 359 Cr as against the PAT of the previous quarter and corresponding quarter i.e. Rs 675 Crore and Rs 440 Crore respectively.

The Company has adopted the Ind AS 116 'Leases', with effect from FY 2019-20. Pursuant to the above, the Company has recognized the 'Right to Use Assets' and corresponding 'Lease Liability' of Rs. 3,829 Cr in FY 2019-20. Classification of the lease rentals has been changed from the 'Cost of the Goods Sold' and 'Rent Expenses', as the case may be, in the profit and loss account to 'Depreciation' and 'Finance Cost'. The application of Ind AS 116 has resulted in decrease in current year PBT by Rs. 500 Cr and PAT by Rs 374 Cr. Over the period of the respective lease terms, the net accounting impact due to application of the Ind AS 116 will be 'Nil'.

The robust financial results in 2019-20, is due to higher volumes processed at the Dahej Terminal with the capacity expansion and better efficiency in operations.

The Board of Directors approved a final dividend of 70 % on equity which is Rs 7/- share, subject to the approval of the shareholders of the Company in the AGM.

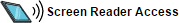

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

Petronet LNG Limited is one of the fastest growing world-class Public Limited Company in the Indian energy sector. It has set up the country's first LNG receiving and regasification terminal at Dahej, Gujarat with present nominal capacity of 17.5 MMTPA and another terminal at Kochi, Kerala having a nominal capacity of 5 MMTPA. The company is also exploring suitable opportunities within and outside India to expand its business presence.

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country

The Company had set up South East Asia's first LNG Receiving and Regasification Terminal with an original nameplate capacity of 5 MMTPA at Dahej, Gujarat. The infrastructure was developed in the shortest possible time and at a benchmark cost. The capacity of the terminal has been expanded in phases which is currently 17.5 MMTPA and the same is under expansion to 22.5 MMTPA in two phases. The terminal has 6 LNG storage tanks and other vaporization facilities. The terminal is meeting around 40% of the total gas demand of the country